GROUP

One-and-Only global provider of visual communication

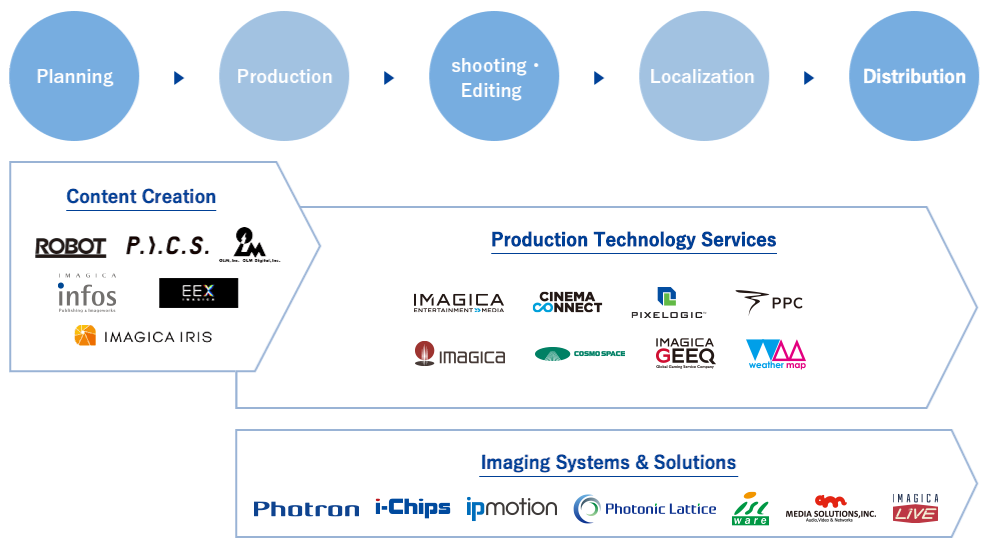

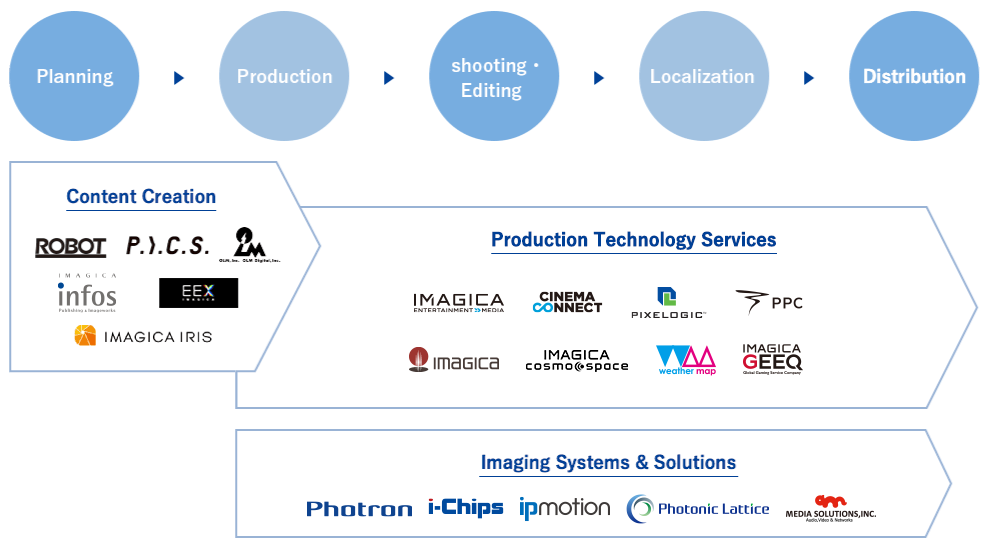

IMAGICA GROUP offers all-around video services globally and at one-stop, from content planning, production, editing, to streaming and distribution. Our excellent products and services reach a wide range of customers not only in the entertainment but also in the industrial and the medical fields. We have a dedicated research and development team working for the entire group, engaged in developing innovative technologies while building and deepening expertise. Implementation of newly created technologies to our group’s businesses enables us to provide video services that are comprehensive and unrestricted by any frames of viewing.

MAIN BUSINESS

Content Creation

Companies in our Content Creation segment pursue creative expressions and are engaged in a wide range of video planning and production: theatrical films; TV dramas; animations; music videos; TV commercials; multimedia advertising and promotion for webpages; and digital signage displays for outdoors and commercial properties. We offer fresh viewer experience at live music and other entertainment events by producing the total space and atmosphere centering around video. A track record built in each of these areas are tied with our IP (intellectual property) business based on publishing, to develop a cross-media business.

Production Technology Services

Providing a one-stop solution for specialized creative services to meet various requests, including Shooting / Editing & Sound Services for film, TV programs, TV commercials, and promotions / DCP (Digital Cinema Package) Creation / Content Distribution & Streaming Services / Digital & Optical Composite / VFX / CGI / Scanning / Recording / Encoding / Image Restoration / Media localization service and more.

We will continue to serve the needs of international content owners, aggregators, broadcasters, and new media distributors.

Imaging Systems & Solutions

Companies in our Imaging Systems and Solutions segment make comprehensible proposals on domestic broadcasting equipment from designing to installation, offer best solution, render broad range of system and network operations support, and expand video usage in the fields of medicine, education, and general industries. With our state-of-the art technology in imaging, we work in the world market not only to meet the needs of broadcasters but top professionals in hospitals, universities, airports, manufacturers, research institutions, and more.